We are thrilled to feature you in this edition of our newsletter. Nigeria faced a disruptive and eventful year in 2020, marked by the Covid-19 pandemic, lockdowns, the #ENDSARS protest, recession, and currency fluctuations. While businesses and economies worldwide continue to recover, Superflux International Limited, under your capable leadership, achieved profits despite the challenging business environment and economic downturn. This interview comes at a perfect time to reflect on these remarkable accomplishments.

In the wake of the Covid-19 pandemic, a compulsory lockdown was imposed by President M. Buhari, locking down the Nation’s capital and the commercial hub while also banning interstate travel and shutting the borders and air space. How were you able to keep the company culture alive and provide leadership for the company including the staff and manage your clients during and after the lockdown?

It hit us like a bolt from the blue. We entered 2020 on a high note, with an impressive first-quarter performance. Then came the lockdown announcement. It wasn’t a scenario outlined in any management textbook or training. We had to adapt quickly and think creatively. Our first step was to set up a WhatsApp platform for the senior management team to address emerging issues and make swift, informed decisions. I stayed in constant communication with the heads of departments to tackle critical challenges throughout the lockdown. I must commend my management team, whose dedication and determination kept the business afloat during such a difficult time.

Managing clients, especially the banks, presented an entirely different challenge. Banks can be demanding, and some insisted on receiving chequebooks despite the lockdown. We had to view the situation from their perspective, knowing banks were categorized as essential service providers and allowed to operate during the lockdown. Those with in-house MICR centers could still supply chequebooks to their key customers, giving them an edge over banks relying on outsourced cheque production from Superflux.

We approached this challenge with care and succeeded in managing it effectively. Thanks to the strong relationships we had built with the banks over the years, we communicated our constraints and assured them of prompt deliveries once conditions improved. Most banks understood our position and remained patient, trusting our commitment to resume services as soon as the situation allowed.

The 2020 events were not anticipated. How was Superflux able to adapt and respond to the challenges faced by businesses including the uncertainty in the business terrain and the cash-crunch fragile economy?

It was an incredibly delicate situation. On one hand, management and the Board were deeply concerned, unsure how long the lockdown would last and fully aware that the organization would continue to incur costs throughout the period. On the other hand, we had a responsibility to consider the welfare of our staff, who relied on their monthly salaries for survival. Striking a balance between these competing demands was no small feat. Thankfully, we navigated that uncertain period successfully and emerged stronger, for which we remain grateful.

What were your key lessons from the Covid-19 crisis, both from a business and a leadership point of view?

A leader must remain calm during a crisis and keep a level head at all times. While many organizations adopted panicked measures in the early weeks of the lockdown in April 2020, we chose a different approach. We believed it was essential to stay composed, monitor events as they unfolded, and assess the situation carefully.

Throughout the lockdown, the management team focused on strategizing for a swift recovery once restrictions were lifted. When the lockdown ended in April, we spent the first two days implementing the policies we had planned during the downtime before allowing the rest of the staff to resume work. By the time they returned, the COVID-19 protocols developed by HR and the HSE committee, along with other changes approved by management, were already in place, ensuring a smooth and safe transition back to operations.

During the pandemic, we have all been awakened to the fact that everything can change in an instant. As a result of the lockdown, employees worked from home till the lockdown was eased. How did the entire workforce adjust to the changes? Did the events of 2020 affect their productivity?

I’m glad you asked this question. It’s nearly impossible for a manufacturing company to function effectively with a work-from-home model. While administrative personnel can manage some tasks remotely, the majority of our workforce operates machines and needs to be physically present on-site. Personally, I believe in leading from the front, and I can’t imagine sitting comfortably at home, making occasional phone calls, and expecting excellent results.

When the lockdown was lifted at the end of April 2020, the government allowed organizations to operate between 9 a.m. and 3 p.m. Almost immediately, banks began demanding chequebooks, creating immense pressure on us to deliver.

We accomplished remarkable feats during this period, meeting the banks’ demands despite the restricted working hours. This success was only possible due to the incredible dedication of our workforce. I still vividly remember addressing the entire staff when operations resumed. I laid out the gravity of the situation, explained what was at stake, and challenged everyone to rise to the occasion to keep Superflux in business. The response was overwhelming—every team member showed determination and a readiness to do whatever it took to weather the storm.

I’m immensely proud of our highly motivated and committed workforce. Their passion and drive are unmatched. I’m also deeply grateful to the Board for their unwavering support, especially in prioritizing staff welfare. Their backing has been invaluable in navigating challenging times like these.

Since March 2020, a lot of businesses experienced business disruption and downtime. How did Superflux not only thrive but triumph better than the previous year?

The success of Superflux lies in the solid foundation established from its inception. Our unwavering commitment to being customer-centric has fostered loyalty and trust among our clients. They rely on us to consistently deliver high-quality services with professionalism, and this trust has turned many of them into long-term partners who view us as solution providers.

The remarkable results we achieved at the end of the 2020 financial year were no accident—they were the product of hard work, dedication, and a relentless pursuit of excellence. I’m especially proud that the entire workforce has been generously rewarded with a substantial bonus in recognition of their efforts.

We owe a great deal of gratitude to the Board for their unwavering support and understanding, which has been instrumental in driving our success. This collaborative effort between the team and leadership continues to be a cornerstone of what makes Superflux thrive.

Nigeria ranked 131 out of 190 countries on the 2020 World Bank Doing Business Index, moving up 15 places from 146th position in the 2019 Report. As the Managing Director of a leading printing company in Nigeria, how easy is it to do business in Nigeria considering the state of Nigerian ports, currency fluctuations, cost of freight, the tax regime escalating costs of raw materials?

Where do I even begin? Is it the exchange rate instability, skyrocketing energy costs, difficulties sourcing foreign exchange, rising shipping expenses, or the nightmare of clearing goods from the ports? Running a business in Nigeria has become increasingly challenging.

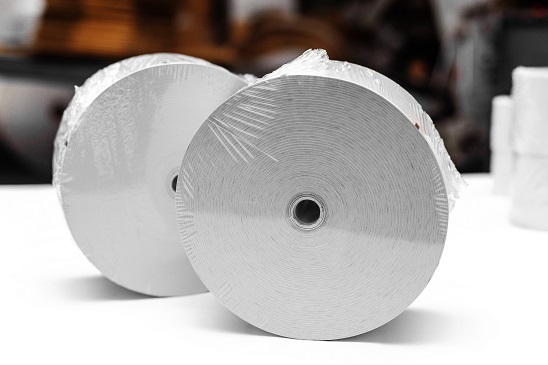

Take, for example, the cost of shipping a 40ft container from China. What used to cost about $3,000 has now surged to between $11,000 and $16,000, all because ships can hover in the waters off Togo for up to three months before finally berthing at Apapa or Tin Can Island Port. Even after clearance, transporting that same container now costs about ₦2 million from the port to Ogba—a sharp increase from the ₦250,000 we paid in 2019. On top of this, our monthly electricity bill has jumped from ₦6 million to ₦12 million, not to mention the additional costs of diesel and gas for generators.

Despite these hurdles, our clients either aren’t aware of the challenges we face or choose to overlook them. But at Superflux, we remain committed to delivering the exceptional service we’ve been known for over the years, regardless of the difficulties. This, I believe, is what separates the men from the boys. Instead of complaining, we focus on adapting and overcoming these obstacles. That resilience is what keeps us moving forward.

Like other sectors of the economy, the print industry has its fair share of disruptions and with covid-19, we are witnessing many paperless and digital solutions. What is the strategy to ensure Superflux remains an industry leader in the print industry and remain profitable?

The rise of electronic payment solutions replacing our traditional product offerings has been a significant concern for us over the past several years. Major paper products like bank statements and dividend warrants have already been phased out due to emerging digital solutions. Cheque usage continues to decline and will inevitably fade away.

To address this challenge, we are actively exploring IT-based and alternative payment solutions to diversify our product offerings and future-proof our business. We recognize that the shift from paper-based products is inevitable, and we are committed to staying ahead of the curve.

To strengthen our efforts, we recently engaged a consultant to bring an external perspective and fresh ideas to our strategy. This collaboration will help us identify innovative solutions that align with the evolving payment landscape and ensure our continued relevance in the market.

After several postponements, the revised Nigeria Cheque Standard is expected to come into effect from the 1st day of April, 2021. As an authority in cheque payment and processing solutions, can you explain for the benefit of the staff some of the key changes between the old and the revised Nigeria Cheque Standard?

While working in the banking industry, I had the privilege of representing my bank in the CBN/MICR Technical Implementation Committee, a technical arm of the Bankers’ Committee responsible for implementing MICR technology in the Nigerian banking system. Prior to 2006, cheque production in Nigeria was unregulated, leading to widespread cheque fraud across the banking sector.

In 2002, the MICR Technical Implementation Committee established a sub-committee to create a temporary cheque standard to address this issue. I was appointed Chairman of this sub-committee, with Mr. Niyi Ajao of the Nigerian Interbank Settlement System serving as Secretary. By 2004, the Bankers’ Committee directed the MICR Technical Committee, under the leadership of Dr. Mrs. Sarah Alade, then Director of the CBN Payment Systems Department, to develop a robust cheque standard for the industry.

Dr. Alade’s tireless efforts, alongside a study tour to countries like France, the UK, South Africa, and Kenya, led to the drafting of the Nigeria Cheque Standard Version 1, implemented in 2006. This standard aimed to:

- Regulate and accredit cheque security printers.

- Produce secure instruments to combat cheque fraud.

- Promote greater efficiency in the clearing system.

- Facilitate image technology, truncation, and archiving within the clearing system.

In 2019, the CBN revised the cheque standard to incorporate advancements made since 2006. I was honored to be invited as an external expert to contribute to this revision. The updated standard (Version 2) introduced several significant features, including:

- An additional check digit for validating MICR codeline fields.

- An expiry date on the codeline, limiting cheque validity to five years from production.

- The inclusion of a QR code on the reverse side of cheques to combat cheque fraud, especially cloning.

The QR code represents a major step forward in fraud prevention, as it makes cheque cloning nearly impossible. Superflux has already upgraded its machines to print QR codes seamlessly, and one of the banks that adopted the solution has reported a significant reduction in fraud incidents. It is anticipated that the CBN will soon mandate this feature across all banks.

Superflux remains committed to staying ahead in technology and security, ensuring that we continue to provide solutions that uphold the integrity of the Nigerian banking system.

Could you please briefly tell us what the management of Superflux is doing to motivate the workforce and improve staff welfare?

We firmly believe that our staff are our greatest asset, and we remain committed to promoting their welfare and keeping them motivated. Let me share some recent initiatives that underscore this commitment:

-

10% Salary Increase: Effective January 2021, we implemented a 10% salary increase across the board. This decision, though risky given the ongoing global economic uncertainty, reflects our confidence in and dedication to our workforce. While many organizations in Nigeria and globally have enforced pay cuts ranging from 20% to 50%, we have continued to prioritize our employees’ financial well-being.

-

Full Salaries During the Pandemic: Since the onset of the COVID-19 pandemic in 2020, we have consistently paid 100% of our staff salaries, demonstrating our unwavering support during these challenging times.

-

Generous Bonuses: At the close of the 2020 financial year, we rewarded our employees with a substantial bonus as recognition for their hard work and dedication.

-

Promotions: Deserving staff were promoted at the end of the 2020 financial year, reinforcing our commitment to recognizing and rewarding excellence.

-

Training and Development:

- Two marketing staff are set to attend a course at Cranfield University in the UK once restrictions on in-person classes are lifted.

- One staff member is currently enrolled in the Senior Management Program (SMP) at Lagos Business School.

- An engineer is in the process of obtaining a visa to the USA for a six-week training program on a newly acquired machine in Atlanta.

- Additionally, we have conducted several local training programs for various staff members in recent months.

These efforts demonstrate our dedication to building a motivated, skilled, and empowered workforce, which we believe is the cornerstone of our continued success.

Where do you see Superflux Int. Ltd in the next 5 years?

My ultimate dream is to leave Superflux as a stronger and better organization than I found it. I envision Superflux evolving into a globally recognized brand, and I firmly believe this goal is within reach, thanks to the exceptional workforce we have built over the years. As I mentioned earlier, we are fortunate to have a team of well-trained, dedicated, and highly motivated individuals who consistently drive our success. Their commitment and expertise give me confidence in the bright future that lies ahead for Superflux.

How do you unwind after the day’s work?

With the current COVID-19 restrictions, socializing has become highly limited. During the week, I usually get home late and exhausted from Monday to Friday. Saturdays and Sundays, however, give me the chance to relax, and enjoy watching football and other sporting events on TV.